MIKULÁŠ PEKSA:

The European Parliament adopted its annual report on the protection of the EU’s financial interests and the fight against fraud (PIF report), for which I was the representative (shadow rapporteur) of our political group (Greens/EFA) .

The PIF report analyses the level of fraud in the European Union and presents the different anti-fraud measures taken by the EU and Member States to remedy the situation. It provides policy recommendations to safeguard EU’s financial interests and ensure that money is well spend.

While the initial draft of this report was rather poor and eurosceptic, since it was drafted by a Member from the extreme right political group (Identity and Democracy Group). To remedy the situation I have tabled around 150 amendments, which were mostly all supported by the other Members, and therefore completely changed content of the text.

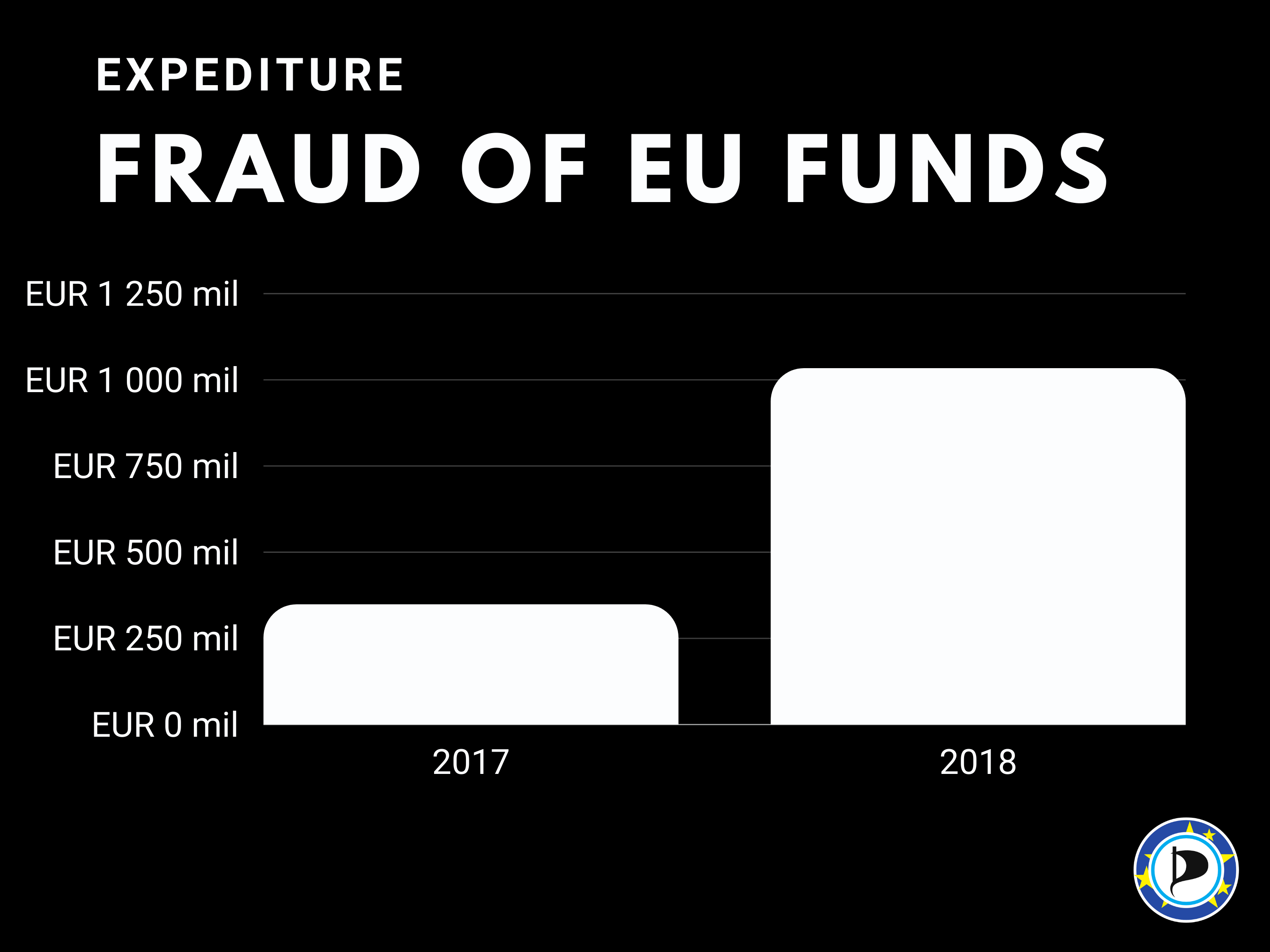

Among the most important facts highlighted in the final PIF report is that expenditure fraud of EU funds, spend by Member States, dramatically increased by almost 200 % compared to 2017 (346.6 million), reaching EUR 1.032 milion in 2018. This is mostly occurring with agriculture and cohesion funds. The VAT fraud inside the EU also cost us around EUR 50 billion annually.

Firstly, the report calls on the Commission to strengthen measures to prevent and detect fraud of the agriculture and cohesion funds by enhancing digital tools, introducing more transparent land registries and publishing lists of the largest beneficiaries from each fund. It also calls on Member States to publish data on final beneficiaries in an uniform machine-readable format and ensure the interoperability of the information.

Moreover, the European Parliament strongly condemns the large-scale misuse of European structural and investment funds by high-level government officials in the Czech Republic, and other public actors in Hungary, Greece, Poland, Romania and Italy, as such fraud is at the expense of small family businesses who need the subsidies the most. The report urges the Council to adopt common ethical standards on all issues related to conflicts of interest and asks the Commission to provide for proper legal protection for investigative journalists along the lines of that provided for whistleblowers.

Member States should fully implement the Directive on the fight against fraud to the Union’s financial interests (PIF Directive), as so far only 12 Member States have respected the transposition deadline of July 2019. The PIF Directive provides common definitions of a number of offences against the EU budget, as well as minimum sanctions. It establishes common rules, which should help improve investigations and prosecutions across the EU. Where Member States fail to comply with the Directive, the Commission should make use of its prerogatives for launching infringement procedures.

In addition, Member States have to prioritize the development of National Anti-Fraud Strategies, as only 11 have done so. Many Member States do not even have specific laws against organised crime, while its involvement in cross-border activities affecting the EU’s financial interests is constantly growing.

Finally, the Parliament also asks the Commission to increase the budget of the new European Public Prosecutors’ Office (EPPO), especially for its build-up-phase, and urges all remaining Member States to join the EPPO as soon as possible. At this stage, Hungary, Poland, Sweden, Denmark and Ireland still refuse that this new body investigates and prosecutes high level criminal cases on their territories.

To sum it up – after a complete change of content we have managed to put together a text that adressess the problems at their core. It is also much cheaper to invest in good protection of public funds and transparency than to bleed from all the fraud cases.

0 comments on “Dramatic increase in fraud of EU funds – what can we do about it?”